Professional Mergers and Acquisitions Advisors: Unlocking Strategic Development

In today's competitive landscape, the duty of expert mergings and acquisitions consultants has actually become significantly pivotal for companies looking for to unlock calculated development. These experts have the acumen to identify practical procurement targets and forge partnerships that straighten with long-term objectives. By navigating the intricacies of transactions and ensuring conformity, they mitigate prospective risks while enhancing functional performance. Yet, the inquiry remains: what particular approaches and understandings do these advisors employ to maximize worth and guarantee success in an ever-evolving market? Recognizing their method can disclose essential advantages for any type of service going for sustainable development.

Role of M&A Advisors

The function of M&A consultants is pivotal in the complex landscape of mergings and acquisitions, commonly acting as middlemans in between buyers and vendors. These professionals possess specialized knowledge and experience that direct clients through the multifaceted procedure of M&A transactions. They carry out thorough market evaluations, assess potential targets, and offer insights right into appraisal approaches, ensuring that celebrations understand the inherent well worth of the entities entailed.

M&A consultants likewise facilitate arrangements, using their settlement skills to bridge gaps between varying passions and purposes. They compose and assess transactional records, guaranteeing compliance with lawful and regulative requirements. This diligence alleviates threats connected with M&An activities, safeguarding customers from potential risks.

In addition, M&An experts utilize their considerable networks to identify tactical collaborations and procurement chances that may not be easily apparent. Their ability to evaluate social fit and functional synergies is critical in cultivating effective combinations post-transaction. Eventually, M&An advisors not only enhance the deal-making procedure but additionally enhance the strategic positioning of their customers, making them vital properties in browsing the elaborate world of mergers and procurements.

Secret Advantages of Professional Guidance

(PKF Advisory)Navigating the intricacies of mergers and procurements can be a complicated job, especially without the assistance of experienced advisors. Mergers And Acquisitions Advisors. The support of professional M&A consultants uses a number of key advantages that can significantly boost the probability of a successful transaction

First of all, skilled consultants bring specialized understanding and market experience, permitting them to identify potential challenges and tactical benefits that may not be instantly obvious to customers. Their competence in assessment strategies ensures that companies are analyzed properly, facilitating fair arrangements.

Second of all, M&A consultants give important market insights, which can cause better decision-making. They examine industry trends and affordable landscapes, outfitting customers with the details needed to make enlightened options.

Finally, M&A consultants function as skilled arbitrators, supporting for their customers' passions and fostering positive communication in between parties. This knowledge not just aids in attaining favorable terms yet likewise minimizes prospective problems, guaranteeing a smoother deal experience.

Identifying Strategic Opportunities

Determining critical chances is a crucial element of the mergings and acquisitions landscape, where recognizing market dynamics can result in considerable competitive benefits. Firms seeking growth must analyze numerous aspects, including industry fads, competitive positioning, and technical innovations, to discover potential targets or collaboration methods.

A detailed market evaluation is necessary for identifying voids and leads within the market. This consists of examining competitors' efficiency, client needs, and arising market segments. By leveraging information analytics and market intelligence, consultants can identify high-potential opportunities that straighten with a business's strategic goals.

Furthermore, reviewing a company's inner capabilities and toughness can reveal locations where purchases can enhance functional performance or broaden item offerings. Identifying harmonies in between organizations is essential, as it takes full advantage of the worth obtained from critical transactions.

Partnership with cross-functional groups, including financing, advertising and marketing, and operations, can additionally enhance the identification procedure. This method promotes an all natural view of potential opportunities and makes sure placement with the organization's general vision. Inevitably, a targeted strategy for identifying calculated possibilities not just supports informed decision-making however additionally placements companies for sustainable growth in a progressively affordable landscape.

Navigating Facility Transactions

Taking part in complex deals needs a deep understanding of both the economic and functional details involved in mergers and acquisitions. These deals typically entail numerous stakeholders, governing factors to consider, and differing social characteristics, making adept navigation essential for success. Advisors should thoroughly examine the critical fit in between companies, looking at harmonies and potential integration challenges.

To efficiently take care of these intricacies, seasoned M&An advisors use an organized strategy, starting with complete due diligence. This process identifies threats and possibilities that might influence the deal's worth and lasting feasibility. Furthermore, advisors facilitate reliable communication in between celebrations to guarantee alignment on purposes and expectations.

Inevitably, browsing intricate deals demands a blend of analytical acumen, strategic insight, and social abilities. By leveraging read what he said these proficiencies, M&An advisors can help companies not just perform effective deals however likewise prepared for sustainable development post-acquisition.

Gauging Success Post-Acquisition

Just how can organizations properly determine the success of an acquisition? Success metrics need to be plainly defined before the procurement is wrapped up.

Beyond monetary performance, qualitative actions are equally crucial - Mergers And Acquisitions Advisors. Employee satisfaction and retention prices can show exactly how well the assimilation process is being obtained within both organizations. Furthermore, customer retention and fulfillment ratings can show the procurement's effect on market presence and brand name stamina

(Mergers And Acquisitions Advisors)Functional effectiveness is another crucial area. Assessing renovations in processes and synergies understood post-acquisition can aid figure out combination success. Companies might likewise think about market share growth as a performance indication, demonstrating the acquisition's performance in boosting competitive positioning.

Inevitably, a thorough evaluation that incorporates measurable and qualitative metrics provides a clearer image of the procurement's success. By on a regular basis keeping an eye on these signs, companies can make informed choices concerning future methods and changes, ensuring the long-lasting value stemmed from the merger or procurement.

Final Thought

In recap, expert mergings and procurements consultants are crucial in facilitating calculated development for companies. Their specialized expertise and extensive networks allow companies to identify and take advantage of procurement opportunities efficiently. By browsing intricate transactions and making sure compliance, these consultants minimize threats and boost functional performance. Eventually, the worth given by M&An experts extends beyond the transaction itself, adding to lasting success and boosted market placing in an increasingly competitive landscape.

Ross Bagley Then & Now!

Ross Bagley Then & Now! Danielle Fishel Then & Now!

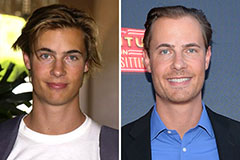

Danielle Fishel Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now!